Featured

Table of Contents

- – The Expanding Need for Financial Obligation Al...

- – Understanding Just How Financial Obligation Me...

- – Personal Bankruptcy Therapy: Called For Steps ...

- – Comparing Nonprofit Service Providers: What Di...

- – Financial Debt Administration Program: The Hap...

- – Red Flags and Indication in the red Alleviation

- – Tax Obligation Ramifications of Forgiven Finan...

- – Deciding: Which Course Forward

- – The Course Towards Financial Healing

Financial challenge rarely reveals itself nicely. One unexpected medical bill, an abrupt job loss, or just the progressive build-up of high-interest bank card balances can transform workable monthly payments right into an overwhelming concern. For numerous Americans lugging five-figure financial debt tons, recognizing the distinctions between debt forgiveness programs, personal bankruptcy therapy, and financial obligation management strategies has become crucial expertise.

The Expanding Need for Financial Obligation Alleviation Solutions

Consumer debt levels continue climbing across the United States, pushing more houses towards looking for expert help. The financial obligation alleviation market has increased correspondingly, producing a complicated market where distinguishing genuine assistance from possibly hazardous solutions calls for mindful assessment.

Nonprofit credit score counseling companies have actually become a much safer option to for-profit financial obligation negotiation companies, which consumer protection companies regularly advise against. These nonprofits usually run under federal and state guidelines requiring clear charge frameworks, complimentary first examinations, and instructional parts alongside direct treatment services.

Organizations approved by the U.S. Division of Justice to provide credit score therapy have to satisfy specific requirements, supplying customers some guarantee of legitimacy. Names like Money Management International, InCharge Debt Solutions, and American Pacific Financial Providers Corp (APFSC) represent developed gamers in this room, each offering variations on core debt alleviation solutions while maintaining not-for-profit status.

Understanding Just How Financial Obligation Mercy Actually Works

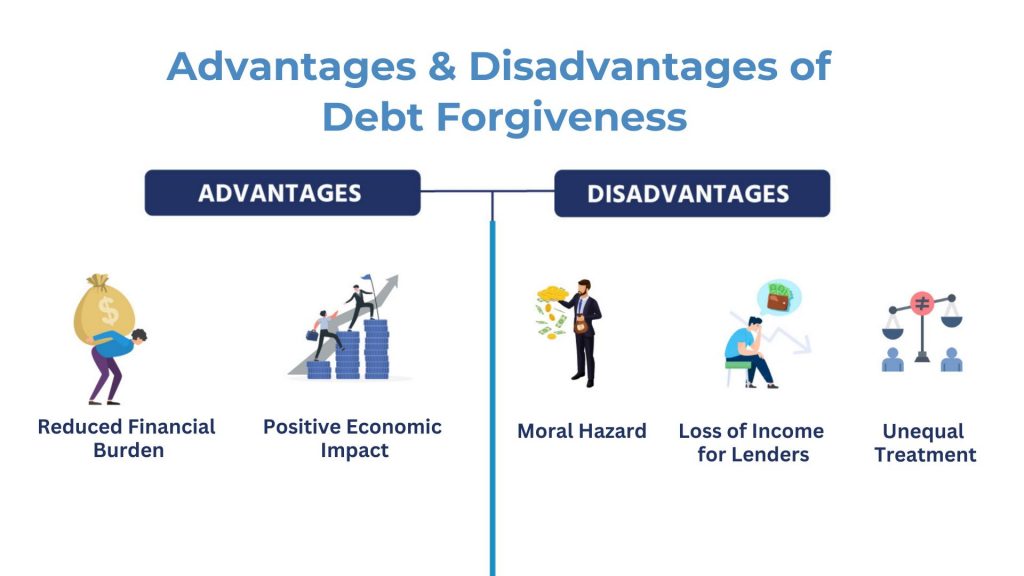

Debt forgiveness, occasionally called financial obligation settlement or "" less than full equilibrium"" programs, operates a straightforward facility: financial institutions approve repayment of less than the complete amount owed, forgiving the continuing to be equilibrium. This method differs essentially from debt administration strategies, where customers repay their complete principal with minimized rate of interest prices.

The procedure commonly calls for accounts to be substantially overdue, generally 120 to 180 days unpaid. At this stage, financial institutions have actually frequently billed off the financial obligation and might like discussed settlements over seeking prolonged collection initiatives or risking full loss via customer personal bankruptcy filings.

Qualified customers function with therapy firms to discuss minimized equilibriums, then develop structured layaway plan spanning roughly 36 months. When all agreed settlements total, financial institutions forgive continuing to be amounts. Some firms, including APFSC and InCharge, offer particular credit rating card financial debt mercy programs structured around these timelines.

However, financial debt forgiveness carries essential factors to consider. Worked out quantities typically impact credit history, though for consumers already in default, this result may confirm marginal contrasted to continuous non-payment damage. Additionally, forgiven debt frequently comprises gross income under federal policies, possibly developing unforeseen tax obligation obligations.

Personal Bankruptcy Therapy: Called For Steps and Readily Available Support

When financial obligation situations exceed what negotiation or monitoring can deal with, personal bankruptcy supplies lawful protection and potential financial obligation discharge. Federal legislation mandates certain therapy requirements for anybody seeking this option, developing opportunities for both education and treatment.

Pre-filing credit therapy should happen prior to sending insolvency paperwork. These sessions assess revenue, financial obligations, and expenditures while checking out options to declaring. Numerous customers find with this process that debt administration plans or mercy programs may solve their circumstances without bankruptcy's long-term credit score implications.

Post-filing borrower education and learning, needed before discharge, concentrates on budgeting abilities, credit history rebuilding techniques, and financial management methods. Both courses generally take 60 to 90 minutes and can be finished online, by telephone, or personally with approved providers.

Organizations like APFSC, InCharge, and countless NFCC member agencies offer these needed training courses, typically charging modest fees around $20 per session with waivers readily available for qualifying individuals. Conclusion generates certifications needed for court filings.

Comparing Nonprofit Service Providers: What Distinguishes Quality Services

Not all nonprofit credit counseling companies provide similar solutions or keep equivalent relationships with financial institutions. Reviewing suppliers needs examining numerous variables past standard nonprofit standing.

Lender partnerships matter considerably. Agencies preserving collaborations with major financial institutions and bank card companies can frequently work out extra positive terms than newer or smaller sized companies. Developed nonprofits generally work with institutions like Chase, Citi, Resources One, Discover, and Bank of America, promoting smoother registration and far better interest price reductions.

Service breadth differs substantially. Some firms concentrate solely on financial obligation monitoring strategies, while others use extensive options consisting of financial debt forgiveness programs, bankruptcy therapy, housing counseling, and specialized solutions for one-of-a-kind conditions like divorce-related financial debt or medical bill negotiations.

The National Foundation for Credit Counseling acts as an umbrella organization connecting customers with licensed counselors nationwide, offering one method for discovering respectable local companies. HUD-approved real estate counseling agencies, including Credit.org with over half a century of operation, offer extra verification of business legitimacy.

Accreditation through companies like the Council on Accreditation or membership in the Financial Therapy Association of America indicates adherence to sector requirements. Consumer examines via systems like Trustpilot, Better Organization Bureau scores, and Google reviews give real-world comments regarding service high quality and outcomes.

Financial Debt Administration Program: The Happy Medium Choice

Between financial debt forgiveness and bankruptcy rests the debt management plan, typically representing one of the most suitable remedy for consumers that can keep structured repayments but fight with high rate of interest.

Via these plans, nonprofit agencies discuss with financial institutions to minimize rate of interest, often dropping them to solitary numbers from the 20-plus percent common on bank card. Late charges and over-limit fees typically obtain forgoed for enrolled accounts. Consumers make solitary regular monthly settlements to the therapy firm, which disperses funds to lenders according to discussed terms.

Strategies normally cover three to five years, with ordinary conclusion around 40 months according to sector information. Unlike debt mercy, consumers settle their complete principal, protecting debt a lot more efficiently while still achieving meaningful cost savings with passion decrease.

Certification requires demonstrating capability to keep settlements throughout the strategy term. Accounts must normally be closed upon enrollment, avoiding added fee while solving existing balances. This trade-off between credit history accessibility and financial obligation resolution represents a vital factor to consider for customers evaluating alternatives.

Red Flags and Indication in the red Alleviation

The financial debt alleviation market however brings in predacious drivers along with legitimate nonprofits. Identifying indication aids consumers prevent solutions that might aggravate their circumstances.

Ahead of time costs prior to solutions render stand for a considerable red flag. Federal guidelines ban financial debt settlement companies from charging costs up until effectively negotiating settlements and getting a minimum of one payment toward the resolved amount. Firms requesting significant settlements prior to showing results likely violate these protections.

Assurances of details savings portions or promises to get rid of financial obligation totally should activate skepticism. Reputable therapists recognize that creditor involvement differs and end results depend on specific circumstances. No agency can ensure lender teamwork or details negotiation quantities.

Suggestions to quit paying lenders while building up funds for negotiation develops substantial danger. This technique, usual among for-profit negotiation companies, creates additional late fees, interest fees, and possible legal actions while damaging debt further. Not-for-profit firms typically dissuade this technique.

Pressure techniques, limited-time deals, or unwillingness to supply written information about fees and solutions recommend bothersome drivers. Reliable nonprofits offer extensive descriptions, response concerns patiently, and allow customers time to make educated choices.

Tax Obligation Ramifications of Forgiven Financial Obligation

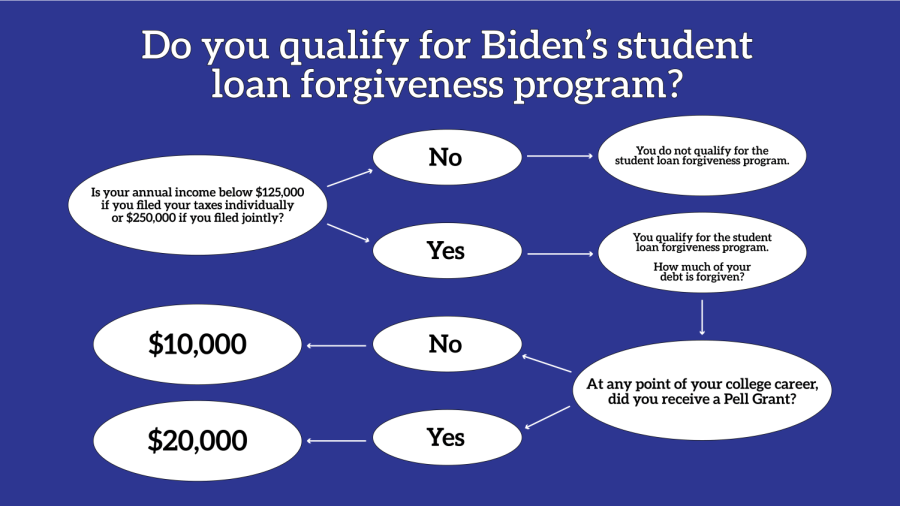

Consumers going after financial debt forgiveness have to understand potential tax obligation effects. Under federal tax obligation legislation, forgiven financial obligation amounts exceeding $600 typically constitute taxed earnings. Creditors report these quantities to the internal revenue service through Kind 1099-C, and customers have to report them on annual tax obligation returns.

For somebody clearing up $30,000 in the red for $15,000, the forgiven $15,000 might enhance gross income considerably, possibly generating unexpected tax obligation obligation. Consulting with tax obligation experts before registering in mercy programs helps consumers get ready for these commitments.

Certain exceptions exist, including insolvency arrangements for consumers whose responsibilities went beyond properties at the time of mercy. Bankruptcy-discharged financial debt likewise obtains various therapy. These complexities enhance the worth of specialist support throughout the financial obligation resolution process.

Deciding: Which Course Forward

Selecting in between financial obligation forgiveness, debt administration plans, and insolvency calls for honest evaluation of private situations. A number of inquiries direct this analysis.

Can you preserve structured repayments over 3 to five years? If of course, debt management strategies maintain debt while minimizing costs. If payment ability is badly restricted, mercy programs or insolvency might confirm better suited.

Exactly how overdue are your accounts? Financial debt mercy typically requires substantial delinquency, making it inappropriate for customers current on repayments that just desire alleviation from high rate of interest.

What are your lasting monetary objectives? Personal bankruptcy stays on credit records for 7 to 10 years, while settled accounts effect scores for shorter periods. Customers preparing major purchases like homes within a number of years may like options with less long lasting credit scores results.

A lot of not-for-profit agencies supply free initial assessments, enabling exploration of options without dedication. Making use of these sessions with multiple providers aids consumers comprehend available courses and make notified choices about which organization and program best fits their demands.

The Course Towards Financial Healing

Frustrating financial debt produces anxiety expanding much beyond economic concerns, impacting health and wellness, relationships, and top quality of life. Understanding offered alternatives stands for the crucial primary step toward resolution and eventual recovery.

Not-for-profit credit rating therapy companies provide structured paths towards debt alleviation, whether via management plans minimizing rate of interest while preserving complete repayment, mercy programs clearing up financial debts for less than owed, or bankruptcy counseling directing customers through lawful discharge processes.

Success requires honest monetary assessment, mindful supplier evaluation, and dedication to whatever resolution plan emerges. The journey from financial situation to security requires time, however millions of customers have browsed it efficiently with suitable expert support.

The Intersection of Technology and Financial Vulnerability: Digital Debt TrapsFor those currently battling under debt concerns, sources exist to aid. The challenge lies not in finding aid but in discovering the right aid, effectively matched to private scenarios and objectives. That matching procedure, embarked on attentively with info gathered from numerous resources, produces the foundation for lasting monetary recovery.

Table of Contents

- – The Expanding Need for Financial Obligation Al...

- – Understanding Just How Financial Obligation Me...

- – Personal Bankruptcy Therapy: Called For Steps ...

- – Comparing Nonprofit Service Providers: What Di...

- – Financial Debt Administration Program: The Hap...

- – Red Flags and Indication in the red Alleviation

- – Tax Obligation Ramifications of Forgiven Finan...

- – Deciding: Which Course Forward

- – The Course Towards Financial Healing

Latest Posts

4 Easy Facts About Expert Guidance Preserves What You've Worked For Explained

Not known Factual Statements About Knowing the Cost of The Role of Mental Health in Financial Stress & How to Cope

Some Ideas on What to Expect During the Debt Settlement vs. Debt Management Plan: What’s Safer for Your Credit? Process You Need To Know

More

Latest Posts

4 Easy Facts About Expert Guidance Preserves What You've Worked For Explained

Not known Factual Statements About Knowing the Cost of The Role of Mental Health in Financial Stress & How to Cope